We’re Acquiring $1 Billion of

DIGITAL DISRUPTORS

The Breakdown

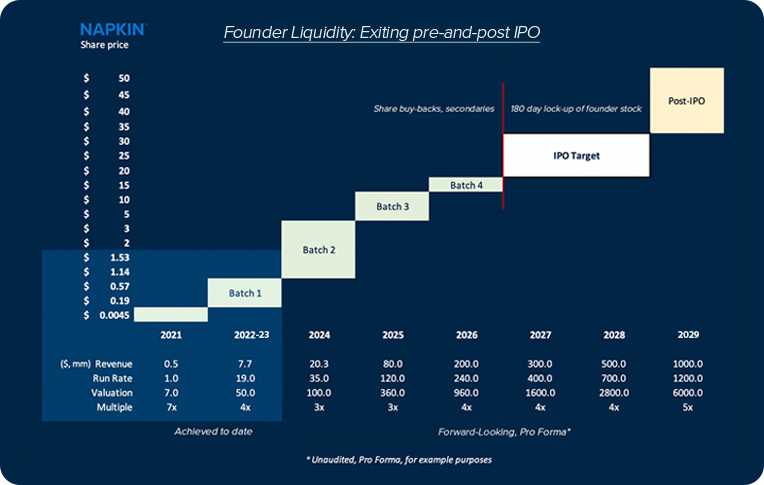

Batching Digital Disruptors

Napkin batches acquisitions, ensuring growth, risk diversification, and transparency. We acquire Digital Disruptors – companies that transform industries and challenge traditional methods.

Founder Advantage

Your equity grows with each batch, boosting your exit value at IPO. Keep your vision and take your business further.

Investor Advantage

We anticipate continuous accretion to net profits and share value.

Simple, creative, and profitable #NapkinDeals

CASH AND STOCK

We are ambitiously looking for great founders with sticky clients, tech, and talent suitable for our cross-selling, founder-driven model. We acquire using cash, Napkin common stock and earn-outs, and actively invest in growth.

POSITIVE CASH FLOW

All companies are value-adding to the Napkin portfolio; have $1m or greater in revenue; and are monthly cash flow-positive (with profitability). This enables us to build relationships with banks & investors, while remaining prudent as we scale together

GROWTH STAGE

We’re here to win. Napkin has some of the best and brightest founders in our industry. Together we engage in cross-selling, service-sharing, expense savings, and individual/collective mindset growth.

Industry Leaders Coming Together as Napkin.

Many people say, “don’t do business with friends”; we say only do business with friends. We have a fairly simple rule: no *ssholes allowed. We believe we can make real impact in each other’s lives by building a strong culture of inclusivity, friendship, and service to one another. We’ve inspired new levels of leadership within each other as we push each other to achieve our collective dream. Will you be the next founder to join our team?

“To be part of Napkin is to live under the maxims of respect for the identity of companies and constant search for integration between enterprises. That is why we live in a day-to-day growth where entrepreneurs from various countries put the best of their abilities to be better together.”

Martha Concayo

CEO, NPKN LATAM

“Joining Napkin Inc. as their accountant from the very beginning is a dream come true. It’s an honor to be part of this incredible journey, ensuring financial clarity and growth for a company I deeply admire. Together, we will build a legacy of success and innovation.”

Suzana Seis-Manto

Corporale Controller, Napkin Inc.

Napkin will go anywhere, to acquire the absolute best

Founded in February 2021, Napkin now has companies in Canada, the USA, Latin America, India, and the UAE. We’re expanding at home and abroad, looking for the best and brightest digital disrupters. This includes (but is not limited to) advertising and creative agencies, SaaS and tech founders, payment solutions, fintechs, development houses, video producers, social media managers, influencer and PR firms, copywriting services, and anyone with clever servicing to the e-commerce and fintech spaces. To inquire about an acquisition, please go to the npkn.com/deals page. We look at all applications – we’re better together!

Napkin has spent over $200 million ad campaign dollars with advertisers such as Facebook, Google, TikTok, Amazon & others

Ask us how we can grow your brand with advertising